Rare Earths

The Rare Earth Market

Rare earth elements are critical enablers of clean energy and electro-mobility. They are used in a wide range of applications that have transformed modern society, and due to their unique physical and chemical properties, are exceptionally challenging to duplicate or replace. Rare earth elements are used in small, but often necessary, amounts in hundreds of different technologies, materials, and chemicals worldwide in commercial, industrial, social, medical, and environmental applications.

A burgeoning application of rare earths is in electric vehicles. Over 90% of all electric vehicles produced to-date use permanent magnet traction motors containing neodymium-iron-boron (“NdFeB”) magnets, which contain the critical rare earth elements neodymium, praseodymium, dysprosium, and terbium. Additionally, electric vehicles contain dozens of micromotors, sensors and speakers powered by NdFeB magnets, which help reduce vehicle weight and thereby increase electric driving range. The rising use of NdFeB magnets in electric vehicles, alongside a growing list of other end-uses and applications, is reflected by strong forecasts for rare earth demand growth for the years ahead.

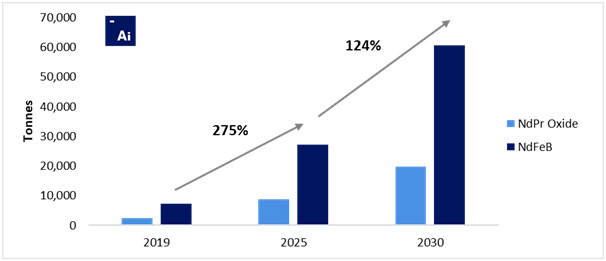

Adamas Intelligence forecasts that global annual passenger EV sales (excluding mild and micro hybrids) will increase from 4.6 million units last year to 14.0 million in 2025 and 34.5 million in 2030. With upwards of 80% of all EVs projected to use permanent magnet traction motors in the years ahead, the rapid rise in EV sales will fuel a 275% increase in demand for rare earths used in passenger EV traction motors between 2019 and 2025, and a further 124% increase in demand between 2025 and 2030.

Aside from passenger EV traction motors, micromotors, sensors and speakers, Adamas Intelligence forecasts strong demand growth for rare earth permanent magnets in the years ahead from applications like commercial EV traction motors, wind power generators, industrial robots, electric scooters and bicycles, energy-efficient consumer appliances, cordless powertools and the ever-growing list of micromotors and sensors used in conventional passenger and commercial vehicles.

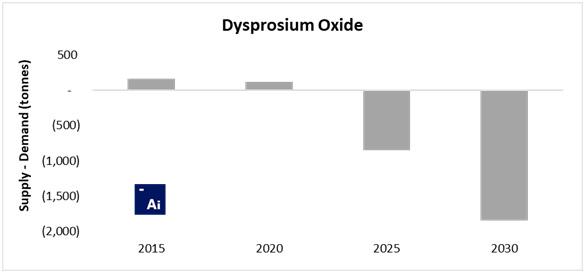

Adamas Intelligence projects that in the next decade, rapid demand growth will challenge the ability of the supply-side to keep up, particularly for neodymium, praseodymium and dysprosium, with global annual demand for these elements expected to increasingly exceed global annual production from 2022 onward, resulting in the depletion of historically-accumulated inventories and, ultimately, shortages unless substantial new sources of supply are developed.

Rare Earths and Electric Vehicles

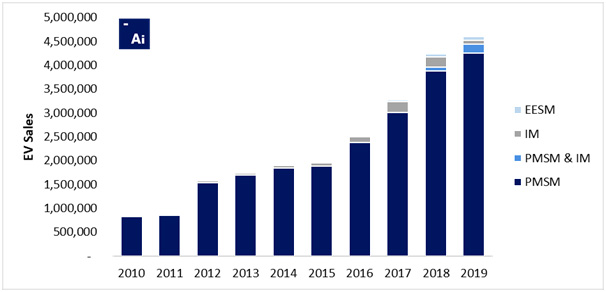

Rare earths are used in a wide variety of applications throughout electric vehicles, but the primary application is within the electric traction motor. There are three main types of electric vehicle traction motors in commercial use: permanent magnet synchronous motors (“PMSMs”), induction motors, and electrically excited synchronous motors (“EESMs”). Of the three motor types, PMSMs are the only variety that contain rare earth permanent magnets.

In 2019, 97% of all passenger EVs sold globally used PM motors, an increase of 3% over the year prior according to a model-by-model build-up using Adamas Intelligence’s “EV Motor Power Monthly” report and data service.

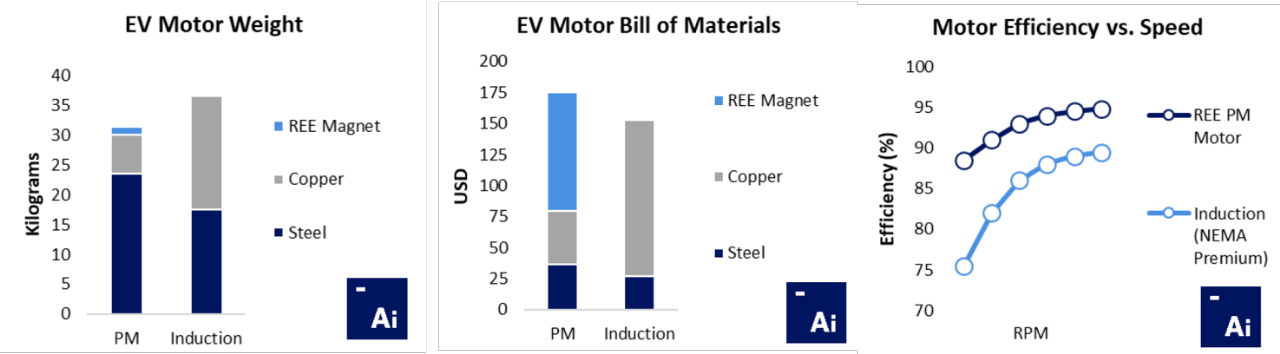

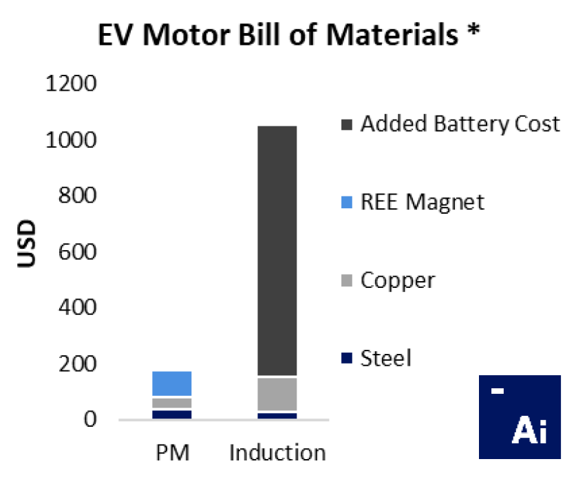

Permanent magnet traction motors are up to 15% more efficient than induction motors and are the most power-dense type of traction motor commercially available (in terms of kW/kg and kW/cm3). Despite generally having a higher bill-of-materials than incumbent traction motor types, such as induction, use of a permanent magnet traction motor is substantially more economically attractive from an automaker’s perspective because its high efficiency enables thrifting of costly battery capacity (in kWh) without compromising vehicle range (distance driven per charge).

For example, the cost of increasing the capacity of a 60-kWh battery pack by just 5% to compensate for use of an induction traction motor can increase powertrain costs by upwards of US $300, which is almost double the entire bill of materials for the permanent magnet traction motor.

Similarly, if increasing the battery capacity of that same 60-kWh BEV by a more realistic 15% to compensate for use of a less efficient induction motor, an automaker would easily be looking at an added battery pack cost of US $900, which is five to six times the entire bill of materials for a comparable permanent magnet traction motor.

As such, Adamas Intelligence contends that the business case clearly supports a future in which automakers overwhelmingly opt to use permanent magnet traction motors in their next-generation electric vehicle designs because it allows them to thrift costly battery capacity while still offering a competitive driving range.

Rare Earths in EV Traction Motors

Adamas Intelligence estimates that, on average, a PMSM traction motor for an EV contains approximately 1.2 kg of NdFeB magnets per 100 kW of peak motor power yielded. During production of this 1.2 kg of NdFeB magnets, Adamas estimates that an additional 0.5 kg of NdFeB alloy is diverted to waste streams during casting, crushing, milling, sintering, cutting, grinding, coating and inspection of the final magnets, and as such, a total of 1.7 kg of NdFeB alloy is consumed per 100 kW of peak motor power.

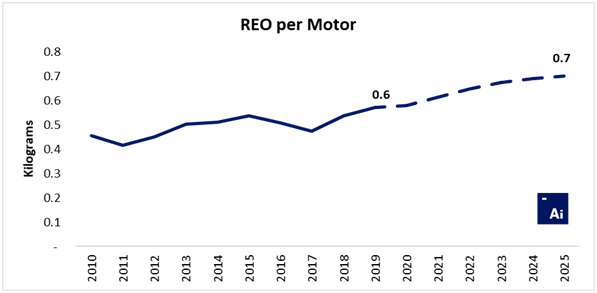

To produce 1.7 kg of NdFeB alloy requires approximately 0.5 kg of rare earth metal inputs (primarily NdPr with lesser Dy and minor Tb) and to produce 0.5 kg of rare earth metal inputs requires an initial 0.6 kg of rare earth oxides, meaning that in total, every 100 kW of permanent magnet traction motor power produced globally creates demand for approximately 0.6 kg of rare earth oxides.

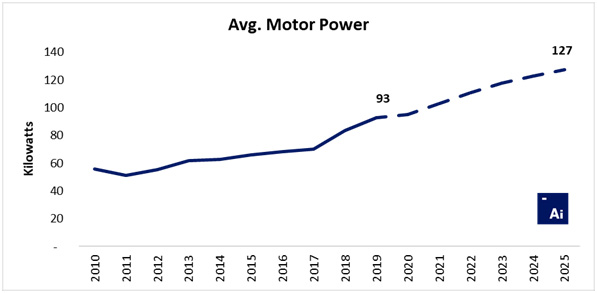

In 2019, Adamas research indicates that globally, the sales-weighted-average EV’s traction motor power totaled 93 kW, almost double what it was in 2010. Looking forward to 2025, Adamas forecasts that, as BEV sales growth continues to outpace PHEV and HEV sales growth globally, the sales-weighted-average motor power will increase to 127 kW in 2025, creating demand for 0.7 kilograms of NdPr oxide (and minor Dy/Tb) for every new EV equipped with a PMSM traction motor.

* Avg. motor power reflects sales-weighted-average of PMSM motors exclusively

Looking ahead, Adamas forecasts that global passenger EV sales (excluding micro and mild hybrids) will rise to 34.5 million units by 2030, of which 73% will be BEVs, 16% will be PHEVs and 11% HEVs.

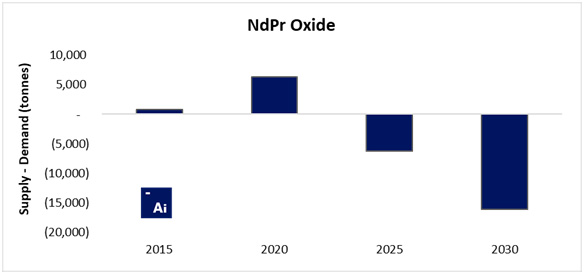

From 2019 through 2030, Adamas Intelligence forecasts that global annual production of neodymium oxide and praseodymium oxide (or oxide equivalents) will increase at a slower rate than global demand, resulting in the draw-down of producer inventories and, ultimately, shortages of these materials if supply is not increased beyond what is currently anticipated.

Even with substantial production increases in China in the years ahead, and the development of 55,000 tonnes-per-annum of new rare earth oxide production capacity outside China, Adamas Intelligence forecasts that global annual demand for neodymium oxide and praseodymium oxide (combined) will exceed global annual production by upwards of 16,000 tonnes in 2030 – equal to the amount of material needed for production of approximately 20 million EV traction motors.

Similarly, from 2019 through 2030 Adamas Intelligence forecasts that global annual demand for dysprosium oxide (or oxide equivalent) will increasingly exceed global annual production, resulting in the depletion of historically-accumulated inventories and, ultimately, shortages of dysprosium if global production is not increased beyond what is currently forecasted.

Specifically, by 2030, Adamas Intelligence forecasts that global demand for dysprosium oxide (or oxide equivalent) will exceed global annual production by upwards of 1,850 tonnes – an amount roughly equal to current global annual mine production.

Ambitious Country and City Targets for EV Adoption

Over the past two to three years, an ever-growing list of countries have announced impending bans on sales of new gasoline- and diesel-powered vehicles by as early as 2025. And similarly, an ever-growing list of cities have announced impending bans that will prohibit use of gasoline- and diesel- (or just diesel-) powered vehicles within city limits by as early as 2024. The nine countries and one U.S. state in the list on the left collectively have potential to fuel EV sales to upwards of 10 million per annum by 2030 and 20 million per annum by 2040 and in doing so, would collectively make a major contribution towards meeting the Paris Climate Commitment targets.

An ever growing list of countries and cities have announced impending bans on sales or use of gasoline-and diesel-powered vehicles (Source. Adamas Intelligence)

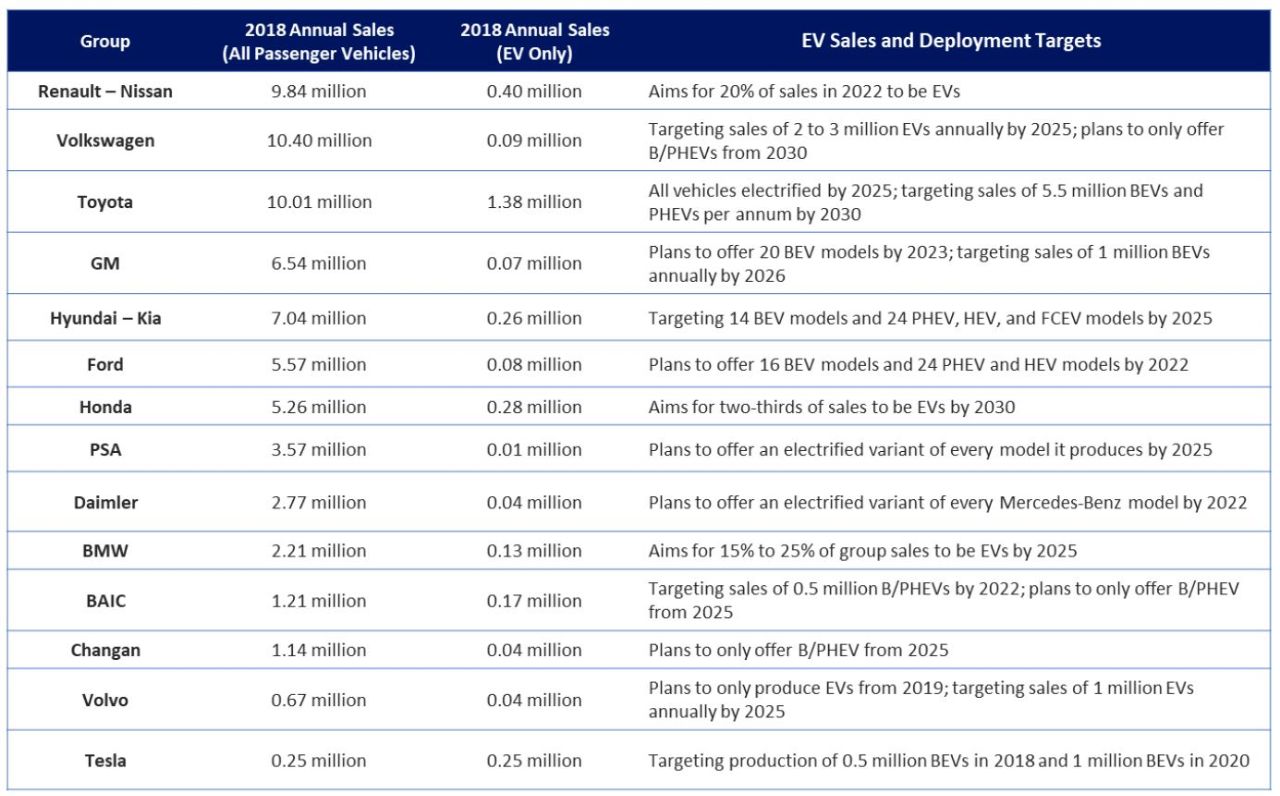

In response to ambitious government policy and the growing list of nations planning to ban sales of gasoline- and diesel-powered vehicles, virtually all the world’s leading automakers have announced equally ambitious electric vehicle production, sales, and deployment targets. For example, Volkswagen is targeting sales of 2 to 3 million electric vehicles per annum by 2025 and plans to only manufacture BEVs and PHEVs from 2030 on. Similarly, Toyota plans to electrify its entire vehicle lineup by 2025 and is targeting sales of 5.5 million BEVs and PHEVs annually by 2030 – an amount equal to roughly half the company’s global sales in 2018. The ambitious targets listed in the table below speak to an industry on the precipice of rapid change. If just a fraction of the automakers listed here successfully realize their near-term aspirations, global electric vehicle deployment will accelerate well beyond the Paris Agreement target by 2030.

Virtually all the world's leading automakers have announced ambitious EV production, sales and deployment targets (Source. Adamas Intelligence, Marklines, EV-Volumes, CAAM)