News

Mkango Announces Maiden Indicated And Inferred Mineral Resource Estimate For The Songwe Rare Earth Project

Calgary, Alberta: October 10th, 2012 -- Mkango Resources Ltd. (TSXV-MKA) (the "Corporation" or "Mkango") is pleased to announce a NI 43-101 compliant mineral resource estimate for the Songwe project in Malawi:

| Cut-off grade | In-situ Indicated Mineral Resource estimate | In-situ Inferred Mineral Resource estimate |

| 1.0% TREO | 13.2 mt grading 1.62% TREO | 18.6 mt grading 1.38% TREO |

| 1.5% TREO | 6.2 mt grading 2.05% TREO | 5.1 mt grading 1.83% TREO |

TREO -- total rare earth oxides. In-situ - no geological losses applied. mt - million tonnes

|

William Dawes, Chief Executive of Mkango stated: "The mineral resource estimates significantly exceed our original expectations and provide a strong platform for accelerated development of the project in what is becoming one of Africa's major emerging rare earth mineral provinces. The heavy rare earth component of the mineral resource estimate equates to approximately 40% of the gross in-situ value at current prices with neodymium accounting for a further 30% on the same basis."

Alexander Lemon, President of Mkango stated: "Malawi's favorable political backdrop, its excellent geological potential and improving infrastructure, including major rail, road and power developments, together with the continued support of the Government of Malawi and its Ministry of Energy and Mines, the Mines Department and Geological Survey, provide a very strong basis for development of this important mineral resource and for Mkango's continued growth in the region."

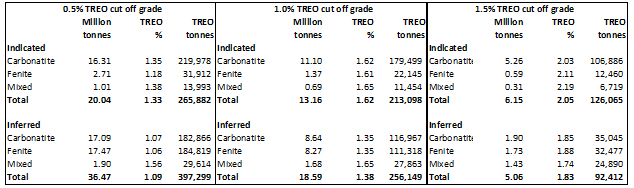

Mineral Resource Estimate

The in-situ mineral resource was independently prepared by The MSA Group of South Africa ("MSA"). MSA, in collaboration and agreement with Dr. Scott Swinden, the "Qualified Person" (QP), has currently identified 1.0% TREO as an appropriate cut-off grade for the mineral resource estimate. This will be further refined on completion of metallurgical test work. The In-situ mineral resource estimates at different cut-off grades are illustrated in Table 1 below.

1Mineral resources which are not mineral reserves do not have demonstrated economic viability

The estimated mineral resource has been traced in drill holes to a maximum depth of 350 m below the surface of Songwe Hill and is based on the two phases of diamond drilling completed by Mkango in 2011 and 2012 totalling 6,850 m. The vast majority of the Indicated mineral resource blocks (at a 1% TREO cut-off, 9.1 mt of carbonatite, 0.67 mt of mixed and 1.04 mt of fenite) are at depths of less than 200 m below the surface of the hill. The areas drilled to date are in an elevated position on the northern slopes of Songwe Hill, which rises approximately 230 m above the surrounding plain. The approximate dimensions of the mineral resource estimate are 400 m aligned northeast by 230 m aligned northwest and to a depth of 350 m below and paralleling the topographic surface of the hill and surrounding plain.

Higher grade areas occur at various locations within the mineral resource, including at or close to surface, particularly in the north eastern part of the carbonatite domain. The mineralisation is not constrained by drilling at depth and laterally to both the northeast and southwest.

Geological domains, comprising either carbonatite or fenite dominant rock types, were used to guide the mineral resource estimate. Where the carbonatite and fenite lithologies were inseparable, a mixed domain was created.

The carbonatite dominant domain generally comprises a higher proportion of elevated TREO grade mineralisation than the fenite dominant domain. This results in a higher proportion of the mineralisation in this domain being reported above the 1% TREO cut off, albeit at a similar average grade to the other domains, as illustrated in Table 2.

The carbonatite domain is dominant at Songwe, comprising 84% of the Indicated and 46% of the Inferred mineral resources.

A schematic geological map illustrating the location of the drill holes will be made available on the Company's website (www.mkango.ca).

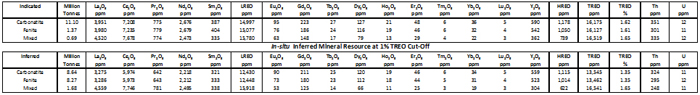

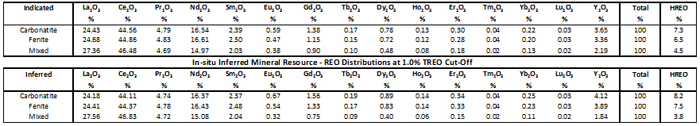

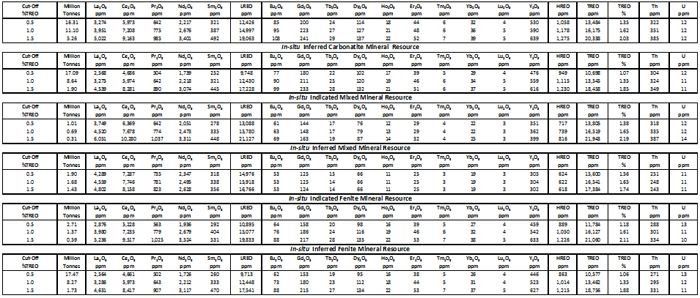

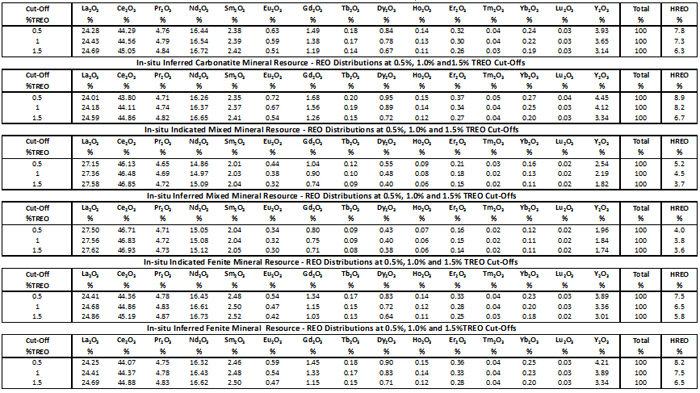

The individual REO data and ratios in Tables 2, 3, 4 and 5 were derived from length-weighted averages of the drill hole database. Heavy rare earths, as defined here, comprise europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium and yttrium. These include the most highly priced of the more commonly traded rare earths, europium, terbium and dysprosium.

The overall weighted average proportion of heavy rare earths as a percentage of total rare earths for Indicated and Inferred resource estimates at 1.0% TREO cut-off grade is 7.1% and 7.4% respectively. The heavy rare earths vary with cut-off grade both in terms of absolute values and relative proportions. As TREO grade decreases, relative proportions of heavy rare earths increases (at 0.5% TREO cut-off grade, the HREO proportion is 7.7% and 8.2% for Indicated and Inferred categories, respectively) and the reverse is also true (at 1.5% TREO cut-off grade, the HREO proportion is 6.1% and 5.8% for Indicated and Inferred categories, respectively).

Apart from the proportion of heavy rare earths, a further measure of the potential value is the proportions of critical rare earths. The US Department of Energy has highlighted neodymium, dysprosium, europium, terbium and yttrium as being "critical" rare earths in terms of their importance to the clean energy economy and risk of supply disruption. Of these, dysprosium, europium, terbium and yttrium are heavy rare earths and are also reflected in the heavy rare earth ratio. Neodymium (Nd) is a light rare earth, principally used in the production of high strength permanent magnets.

The Songwe Hill deposit contains a weighted average of 2,665 ppm Nd2O3and 2,240 ppm Nd2O3in the Indicated and Inferred categories at 1.0% TREO cut-off grade, respectively. This equates to a weighted average proportion of Nd2O3 as a percentage of total rare earth oxides for Indicated and Inferred categories of 16.5% and 16.3%, respectively.

Metallurgical Scoping Test Work

Metallurgical scoping work at Mintek in South Africa is ongoing, comprising flotation test work and leach tests. The current flotation test work is focused on a similar reagent regime to that used previously at the Mountain Pass mine and variations thereof. Further reagent regimes and conditions will continue to be tested. Rare earth mineralogy at Songwe is well understood, comprising synchysite and apatite.

HREO -- heavy rare earth oxides

1Mineral resources which are not mineral reserves do not have demonstrated economic viability

Key assumptions, parameters and methods used to estimate the Mineral Resources

- wireframing of the three lithological units was based on surface geological mapping extended to depth using the drillhole intersection data;

- TREO, HREO, Th and U grades as well as Density were determined using Ordinary Kriging interpolation into individual 3-Dimensional block models constrained by the respective lithological wireframes;

- the lithological block models comprised sub-celled block dimensions of 5 m x 5 m x 5 m.

- the lithology wireframes and block models were truncated to the topographic surface;

- no capping or cutting to limit any input grade data was undertaken as part of the mineral resource estimation;

- Datamine Studio 3 was the modelling package; and

- mineral resource classifications were assigned as Indicated and Inferred based on the degree of measurable continuity of geological and grade data.

Scientific and technical information, including data verification, contained in this release has been approved and verified by Dr. Scott Swinden of Swinden Geoscience Consultants Ltd, who is a "Qualified Person" in accordance with National Instrument 43-101 -- Standards of Disclosure for Mineral Projects.

Sample preparation and analytical work for the drilling and channel sampling programmes were provided by Intertek-Genalysis Laboratories (Johannesburg, South Africa and Perth, Australia) employing ICP-MS techniques suitable for rare earth element (REE) analyses and following strict internal QAQC procedures inserting duplicates, blanks and standards. Internal Laboratory QAQC was also completed to include blanks, standards and duplicates.

The NI 43-101 compliant technical report in respect of the mineral resource estimates described herein will be filed on SEDAR within the next 45 days.

The Songwe Hill Rare Earth Project

The Songwe Hill rare earth project is located within a 100% owned exclusive prospecting licence covering an area of 1,283 km2 in southeast Malawi (the "Phalombe Licence"). Songwe is accessible by road from Zomba, the former capital, and Blantyre, the principal commercial town of Malawi. Total travel time from Zomba is approximately 2 hours, which will reduce as infrastructure continues to be upgraded in the area.

Mkango Resources Ltd.

Mkango's primary business is the exploration for rare earth elements and associated minerals in the Republic of Malawi. It holds, through its wholly owned subsidiary Lancaster, a 100% interest in two exclusive prospecting licenses covering a combined area of 1,751 km2 in southern Malawi. The main exploration target is the Songwe Hill rare earth deposit, which features carbonatite hosted rare earth mineralisation and was subject to previous exploration in the late 1980s.

The Corporation's corporate strategy is to further delineate the rare earth mineralisation at Songwe Hill and secure additional rare earth element and other mineral opportunities in Malawi and elsewhere in Africa.

For further information, please contact:

Mkango Resources Ltd.

Office +1 (403) 444 -- 5979

Fax +1 (403) 351 -- 1703

William Dawes

Chief Executive Officer

will@mkango.ca

Alexander Lemon

President

alex@mkango.ca

Cautionary Note Regarding Forward-Looking Statements

This news release may contain forward-looking statements relating to the Corporation. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. By their nature, forward-looking statements involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will not occur, which may cause actual performance and results in future periods to differ materially from any estimates or projections of future performance or results expressed or implied by such forward-looking statements. Such factors and risks include, among others, the interpretation and actual results of current exploration activities; uncertainty of estimates of mineral resources, changes in project parameters as plans continue to be refined; future commodity prices; possible variations in grade or recovery rates; failure of equipment or processes to operate as anticipated; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of exploration.

The forward-looking statements contained in this press release are made as of the date of this press release. Except as required by law, the Corporation disclaims any intention and assume no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities law. Additionally, the Corporation undertakes no obligation to comment on the expectations of, or statements made, by third parties in respect of the matters discussed above.

The TSX Venture Exchange has neither approved nor disapproved the contents of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.